How German Tax Advisors Can Automate Regulatory Updates

German tax advisors constantly deal with changing laws, regulations, and policies. However, many government websites don’t provide alerts, forcing advisors to manually check for updates—an inefficient and time-consuming process. ScrapX automates tax update tracking by monitoring key websites and sending instant alerts when something changes. This means tax professionals no longer have to check multiple sites manually.

The Challenge

Tax advisors in Germany must stay updated on frequent tax law changes, government announcements, and technical updates. This takes time and increases the risk of missing important changes.

Here are some key websites that German tax advisors often check:

pilot.datev.de

- This platform shares updates about new features and tests within the DATEV system.

- Accounting firms and expert advisors need this information to prepare for technical changes early.

datev-status.de

- This site provides real-time status updates about technical issues or maintenance on DATEV.

- German tax consultants and financial advisors rely on this for smooth operations.

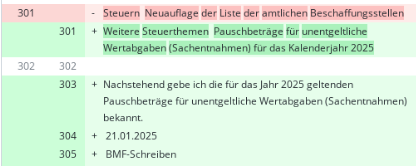

BMF Letters

- The German tax authorities publish official circulars here.

- These updates affect tax declarations, German income tax returns, corporate taxes, and foreign investment income.

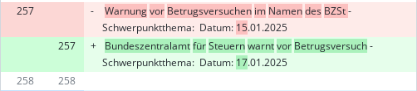

bzst.de

- The Federal Central Tax Office shares announcements here.

- TTax professionals rely on this site for updates on annual filing requirements, payroll tax adjustments, and corporate tax deadlines.

Since these platforms don’t send automatic alerts, tax advisors—including those specializing in cross-border tax challenges, German tax services, and non-resident taxation—must constantly check for updates.

The Solution with ScrapX

ScrapX provides a solution by automatically tracking these sites and sending alerts when something changes. This saves time and ensures that advisors, from freelancers to leading tax advisors and law advisors, always stay informed.

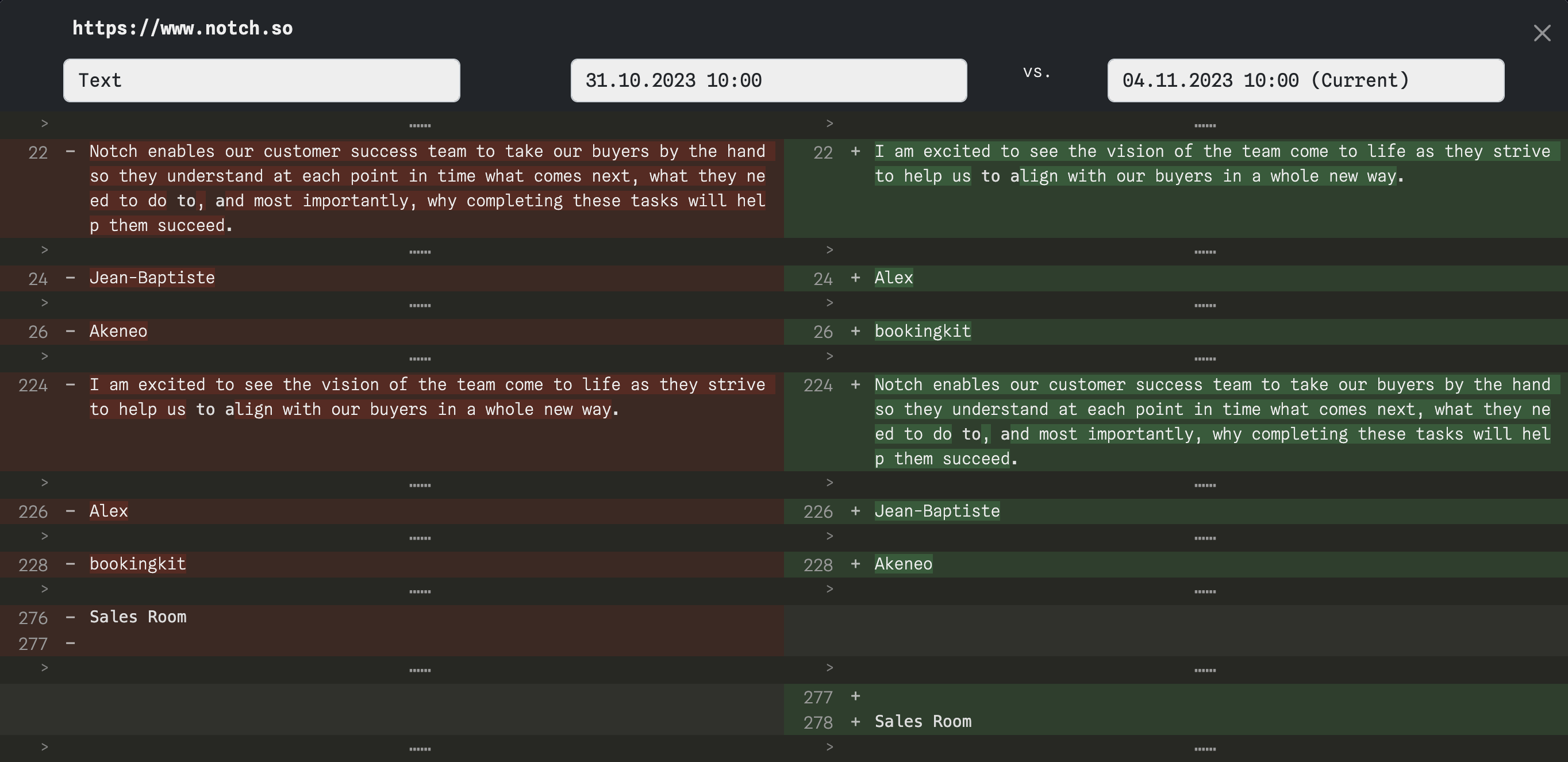

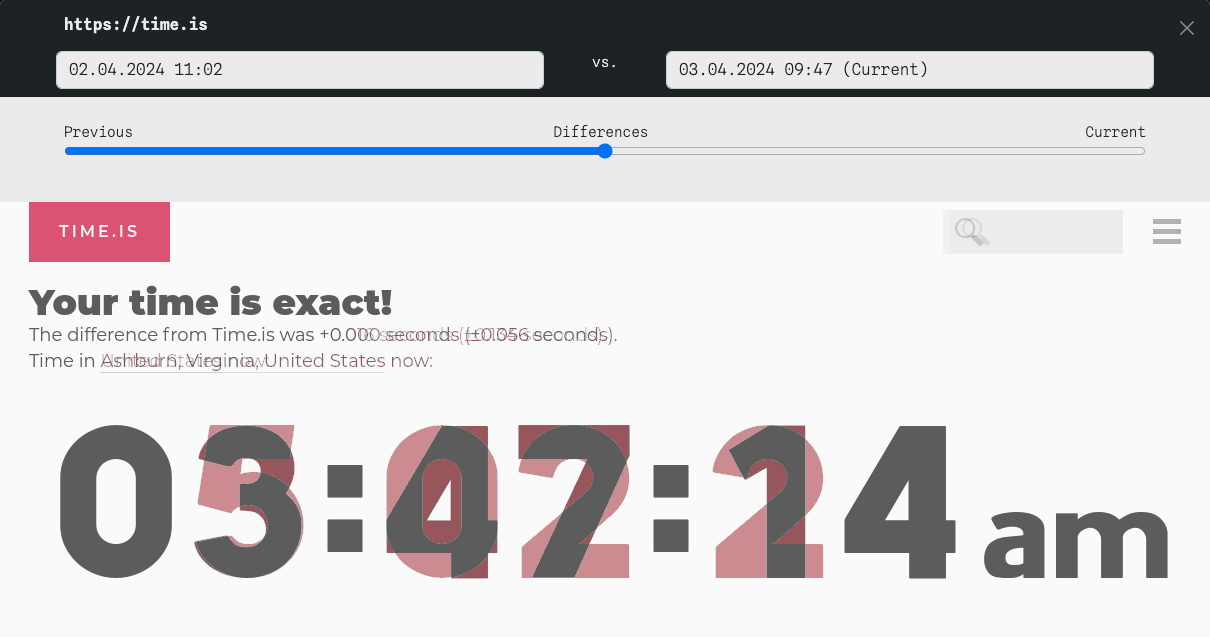

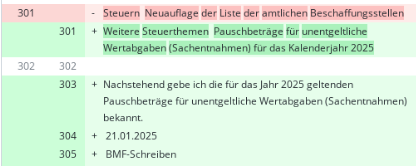

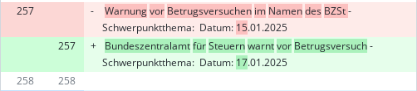

Detecting Text Changes for Accurate Updates

Many government and financial websites publish tax updates as text-based content. ScrapX’s textual change detection continuously scans these pages and highlights any additions, deletions, or modifications.

Visual Change Detection for Hidden Updates

Not all updates are purely text-based. Many tax-related websites present critical information in PDFs, images, tables, or embedded charts, making them harder to track. ScrapX’s visual change detection compares screenshots of web pages and highlights even the smallest visual modifications.

This feature is essential for corporate clients, high-net-worth individuals, and expert advisors who need to track legal and tax policy changes that are sometimes published as official scanned documents or visual notices.

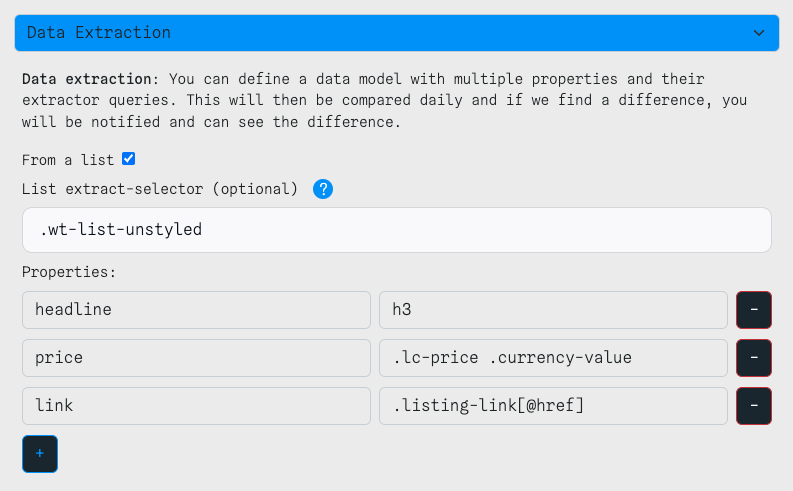

Extracting Key Data for Fast Access

Many German tax authorities publish tax regulations in lengthy documents, tables, or structured formats that require manual extraction. ScrapX’s data extraction helps law advisors, accounting firms, and managing partners pull out relevant tax information quickly and efficiently.

This is particularly helpful for English-speaking tax advisors, expat tax advisors, and business tax advisors who need to quickly review personal tax services, corporate tax updates, or annual filing requirements for multiple clients.

How It Works

Using ScrapX is easy. Here’s how you can do it:

- Add websites: Enter the URL of the site you want to track, such as BMF Letters, DATEV, or the Federal Central Tax Office.

- Define changes: Choose whether you want to monitor full texts, specific sections, or only visible content.

- Receive notifications: Get instant alerts via email, Slack, or webhook whenever something changes.

Benefits of Using ScrapX

Here’s why ScrapX is a game-changer:

- Saves Time: No more refreshing pages or visiting multiple websites every day. ScrapX monitors tax-related sites for you and sends alerts whenever something changes. This is especially useful for busy tax advisors, accounting firms, and financial advisors who need to stay updated on regulations without wasting hours searching for updates.

- Instant Updates: Tax rules and technical updates can change quickly. With ScrapX, you get real-time alerts as soon as new information appears. Whether it’s a BMF circular, a DATEV system update, or a Federal Tax Office announcement, you’ll know about it immediately—helping you react faster and make informed decisions.

- Works with Your Existing Workflow: ScrapX isn’t just another tool to check. It integrates with Slack, email, and webhooks, so updates fit right into your daily routine. Whether you’re a law advisor, corporate tax consultant, or handling personal tax services, you’ll get alerts in a way that works best for you.

- Tracks Secure Content: Tracks Secure Content: Some tax-related websites require logins or have protected areas where important updates are posted. ScrapX can track these sections, too, ensuring you never miss critical changes, even in restricted areas. This is ideal for German tax advisors handling corporate tax filings, payroll taxes, and legal tax advice.

Practical Examples

ScrapX helps tax advisors monitor key websites that don’t offer automatic alerts. Here’s how it works for some important tax platforms:

pilot.datev.de

This site provides updates on new DATEV features and tests. Staying informed helps tax advisors prepare for technical changes and avoid disruptions. ScrapX tracks all changes so advisors don’t miss important system updates.Visual Detection: https://pilot.datev.dedatev-status.de

DATEV regularly posts status updates on technical issues and maintenance. ScrapX monitors this page, ensuring financial advisors and tax consultants get immediate alerts when there’s a problem—so they can adjust their workflows accordingly.Visual Detection: https://www.datev-status.deBMF Letters

The Federal Ministry of Finance publishes tax circulars here that directly impact tax declarations, corporate tax filings, and tax positions. ScrapX detects and highlights new circulars instantly, helping tax advisors stay ahead of policy changes.Textual Detection: https://www.bundesfinanzministerium.de/Web/DE/Service/Publikationen/BMF_Schreiben/bmf_schreiben.html

bzst.de

The Federal Central Tax Office posts announcements about forms, procedures, and tax policy updates. ScrapX ensures tax professionals are notified when something important is published—eliminating the risk of missing critical updates. You must use exactly these Get parameters in the URL so that you get the current results displayed first.Textual Detection: https://www.bzst.de/DE/Home/Meldungsuebersicht/MeldungsUebersicht_Formular.html?sortOrder=showDOMTime_int+asc%2C+dateOfIssue_dt+desc

Stay Ahead with ScrapX

Keeping up with tax updates doesn’t have to be stressful. With ScrapX, you get real-time alerts, automated tracking, and seamless integration with your workflow.

Whether you're dealing with corporate taxes, income tax filings, or foreign investment income, ScrapX saves time and keeps you informed.

Stop wasting time on manual checks—let ScrapX handle it for you.

Frequently Asked Questions

1. What is ScrapX, and how does it help tax advisors?

ScrapX is an automated monitoring tool that tracks changes on important tax-related websites, such as DATEV, BMF Letters, and the Federal Central Tax Office. It sends real-time alerts whenever updates occur, eliminating the need for manual checking.

2. Why do tax advisors need automated website tracking?

Tax laws, regulations, and official announcements frequently change, but most government websites do not offer newsletters or alerts. ScrapX ensures that tax advisors receive timely notifications about important updates, preventing missed changes that could impact tax filings and compliance.

3. How does ScrapX detect changes on tax websites?

ScrapX uses text change detection to track modifications in written content, visual change detection to identify changes in PDFs, images, and tables, and data extraction to pull structured data from complex documents.

4. Can ScrapX monitor multiple tax-related websites at once?

Yes, ScrapX allows users to track multiple websites simultaneously, including pilot.datev.de, datev-status.de, the Bundesfinanzministerium (BMF), and bzst.de. It continuously scans these sites and sends alerts when new content appears.